Empower Your Business: Bagley Risk Management Insights

Comprehending Animals Risk Protection (LRP) Insurance: A Comprehensive Overview

Browsing the realm of animals threat security (LRP) insurance policy can be a complicated venture for many in the farming market. From how LRP insurance coverage functions to the different coverage options available, there is much to uncover in this detailed overview that can possibly form the method animals producers approach danger monitoring in their companies.

How LRP Insurance Policy Functions

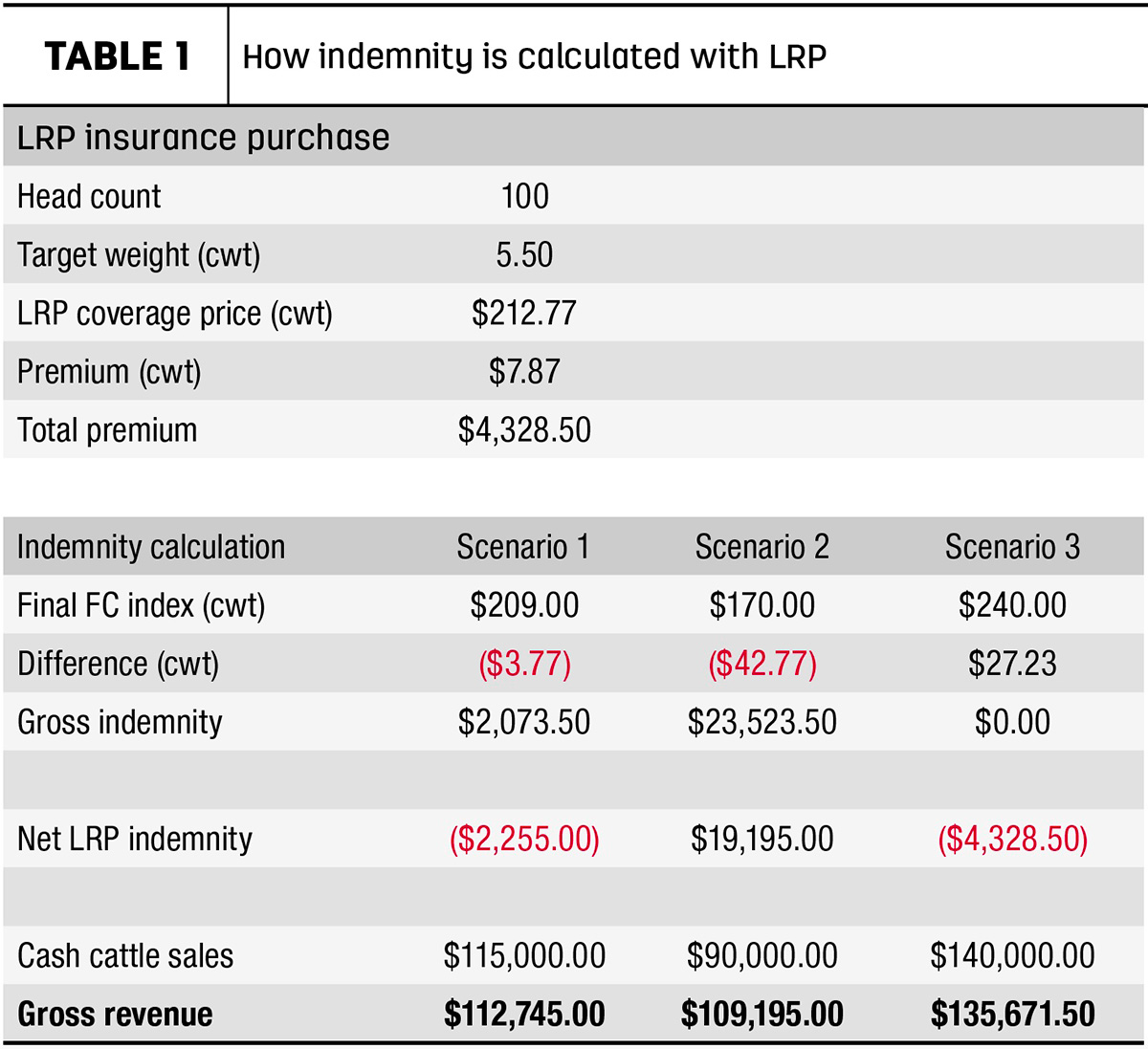

Occasionally, comprehending the mechanics of Animals Danger Security (LRP) insurance coverage can be intricate, but damaging down how it works can give clarity for herdsmans and farmers. LRP insurance policy is a threat administration device developed to secure animals manufacturers against unanticipated rate declines. It's crucial to keep in mind that LRP insurance policy is not a profits assurance; rather, it concentrates solely on cost risk security.

Eligibility and Protection Options

When it comes to insurance coverage options, LRP insurance provides producers the versatility to select the protection level, protection duration, and recommendations that finest fit their danger monitoring requirements. By understanding the qualification requirements and protection alternatives readily available, livestock manufacturers can make informed choices to handle risk successfully.

Benefits And Drawbacks of LRP Insurance Coverage

When assessing Animals Threat Security (LRP) insurance, it is vital for livestock producers to evaluate the downsides and advantages inherent in this danger management device.

Among the main benefits of LRP insurance is its ability to give defense against a decline in animals costs. This can aid secure producers from economic losses resulting from market fluctuations. In addition, LRP insurance offers a degree of adaptability, permitting producers to customize protection levels and policy periods to suit their certain demands. By securing a guaranteed rate for their livestock, producers can much better take care of risk and plan for the future.

Nevertheless, there are likewise some downsides to think about. One limitation of LRP insurance is that it does not shield versus all types of threats, such as disease episodes or all-natural catastrophes. Additionally, premiums can sometimes be pricey, specifically for producers with huge livestock herds. It is critical for producers to very carefully examine their private risk direct exposure and economic circumstance to establish if LRP insurance policy is the ideal risk monitoring device for their operation.

Recognizing LRP Insurance Coverage Premiums

Tips for Optimizing LRP Benefits

Maximizing the benefits of Livestock Threat Defense (LRP) insurance coverage calls for critical preparation and positive danger monitoring - Bagley Risk Management. To maximize your LRP insurance coverage, consider the following tips:

On A Regular Basis Evaluate Market Conditions: Stay educated concerning market patterns and rate changes in the livestock industry. By monitoring these aspects, you can make enlightened choices regarding when to acquire LRP coverage to protect against prospective losses.

Set Realistic Coverage Levels: When picking coverage degrees, consider your manufacturing prices, market price of animals, and possible dangers - Bagley Risk Management. Setting reasonable protection levels makes sure that you are properly protected without overpaying for unnecessary insurance policy

Expand Your Coverage: As opposed to relying solely on LRP insurance policy, consider expanding your danger administration techniques. Combining LRP with various other danger management devices such as futures agreements or alternatives can supply thorough insurance coverage against market unpredictabilities.

Testimonial and Change Insurance Coverage Routinely: As market conditions transform, periodically review your LRP coverage to guarantee it aligns with your existing threat exposure. Adjusting insurance coverage degrees and timing of purchases can aid enhance your risk security technique. By adhering to these suggestions, you can optimize the benefits of LRP insurance and guard your livestock procedure against unpredicted risks.

Final Thought

In conclusion, animals danger defense (LRP) insurance is a beneficial tool for farmers to handle the monetary risks connected with their animals procedures. By understanding how LRP works, eligibility and coverage choices, along with the advantages and disadvantages of this insurance coverage, farmers can make informed decisions to secure their livelihoods. By thoroughly thinking about LRP costs and carrying out approaches to take full advantage of benefits, farmers can alleviate prospective losses and make certain the sustainability of their operations.

Livestock manufacturers interested in obtaining Livestock Danger Security (LRP) insurance coverage can explore an array of qualification criteria and check out here protection choices tailored to their address certain animals procedures.When it comes to insurance coverage choices, LRP insurance policy offers producers the flexibility to choose the protection degree, coverage duration, and endorsements that finest fit their risk management demands.To grasp the intricacies of Livestock Threat Defense (LRP) insurance policy totally, recognizing the variables affecting LRP insurance coverage premiums is vital. LRP insurance policy costs are identified by various aspects, including the protection level selected, the expected rate of animals at the end of the coverage duration, the type of livestock being insured, and the length of the insurance coverage period.Evaluation and Readjust Protection Routinely: As market problems transform, regularly review your LRP insurance coverage to ensure it straightens with your present risk exposure.